Blogs Chapter

Toggle16 Jun 2025, 06:56 PM

For many, buying the first car is a lifelong dream filled with excitement and pride. That first set of wheels holds a special place in our hearts, symbolizing freedom, independence, and accomplishment.

The good news? With flexible financing options, competitive pricing, and a wide range of vehicles available, you can find the best car to turn this dream into reality is more achievable than ever. Whether new or pre-owned, today everybody has more opportunities to find their perfect match. You can make this milestone purchase with confidence and joy by following smart tips for first-time car buyers.

Simply put, buying your first car is an exciting milestone, but it can also feel overwhelming. With so many options, financing choices, and dealership tactics, first-time car buyers need a clear plan. Let us go through some essential tips for first-time car buyers to help you make a smart, confident decision.

The open road awaits!

Blogs Chapter

ToggleBefore stepping into a dealership, determine how much you can comfortably spend. First-time car buyers often overlook additional expenses like insurance, fuel, and maintenance. Calculating your total monthly costs—including loan payments—will help you avoid financial strain. You can also find car loan providers online and check which offer you have is more suitable to your budget. You can narrow down choices and avoid overspending on your first car by setting a budget early.

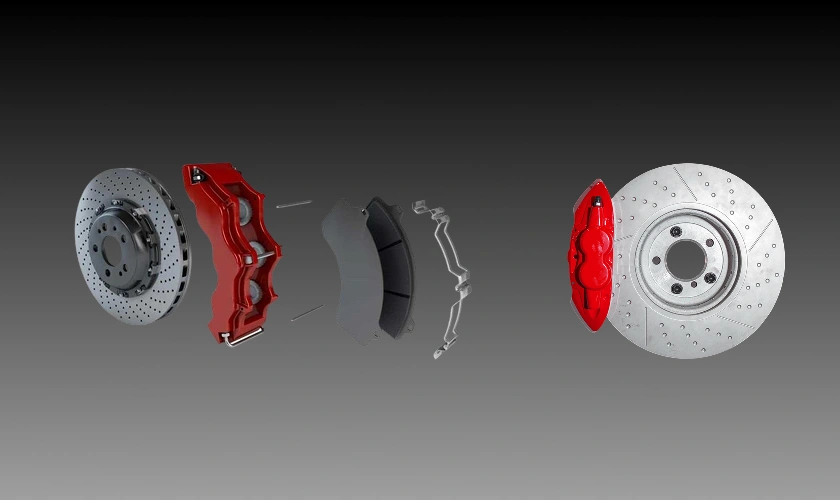

Not all cars are created equal—some are for city driving, while others are better for long commutes. First-time car buyers should research reliability, fuel efficiency, and safety ratings before deciding. One of the best options is to search a comprehensive car portal such as CarOnPhone to get all the details about new and old cars. Taking time to compare models ensures you pick the best first car for your lifestyle.

What to Look For:

Walking into a dealership without financing pre-approval puts you at a disadvantage. Banks and credit unions often offer better rates than dealership financing, giving first-time car buyers more negotiating power. Securing financing early helps you stick to your budget when buying your first car.

Financing Tips:

A car might look great online but feel uncomfortable to drive. First-time car buyers should always test drive multiple vehicles to assess comfort, visibility, and handling. Never skip a test drive—it’s the best way to know if a car suits you.

What to Test During a Drive:

Dealerships expect negotiation, so first-time car buyers should never accept the first offer. Research fair market prices (using Kelley Blue Book or Edmunds) and be ready to walk away if needed. With the right approach, you can save thousands on your first car.

Negotiation Strategies:

Insurance can be surprisingly expensive for first-time car buyers, especially with sporty or luxury models. Get quotes beforehand to avoid sticker shock. Picking an affordable-to-insure car keeps long-term costs manageable.

Ways to Lower Insurance:

Before signing paperwork, first-time car buyers should review all documents carefully. Dealerships may add unnecessary fees or extended warranties you don’t need. Taking these steps ensures a smooth and fair purchase of your first car.

Final Checklist:

Buying your first car is a big decision, but with the right tips for first-time car buyers, you can navigate the process confidently. From setting a budget to negotiating and finalizing the deal, each step matters. Research, compare, and take your time—your perfect first car is out there!

You can follow the latest car news, and as a first-time car buyer, you can gain knowledge and drive away with a great deal and peace of mind. Happy car shopping!

CarOnPhone is your one-stop destination to see all upcoming cars, latest cars, released cars, and EV Cars, and compare Cars in all Car Brands. Stay tuned and follow us to update yourself on the automotive world.