“E27 to Flex-Fuel” and “CAFE 3 norms” are substantial words. If you’re wondering how they fit together, you’re not alone.

Put them together, and you get a big shift in India’s auto market. The choices car brands make now could shape prices, features, and fuel options by 2027.

Government of India has plans to initiate the third phase of Corporate Average Fuel Efficiency (CAFE) standards in April 2027. This move could tighten fleet-level CO2 targets for every automaker in India.

Policymakers say CAFE 3 will not only favor electric vehicles, but also recognize flex-fuel tech, so ethanol-blend capable engines can count meaningfully toward compliance, cutting oil imports and emissions.

This balancing act is new, and it changes industry incentives in a real way.

According to this official proposal, the average CO2 limit for carmakers would change to 91.7 g/km from 113.1 g/km.

CAFE 3 comes into alignment with the WLTP protocol, which is a more realistic testing method than older cycles.

Automakers argue that the give timeline and drop are tough to meet without major portfolio changes. They also emphasize the need for new powertrains, and/or to make bigger bets on hybrids, EVs, and flex-fuel capable vehicles to meet the official mark come 2027.

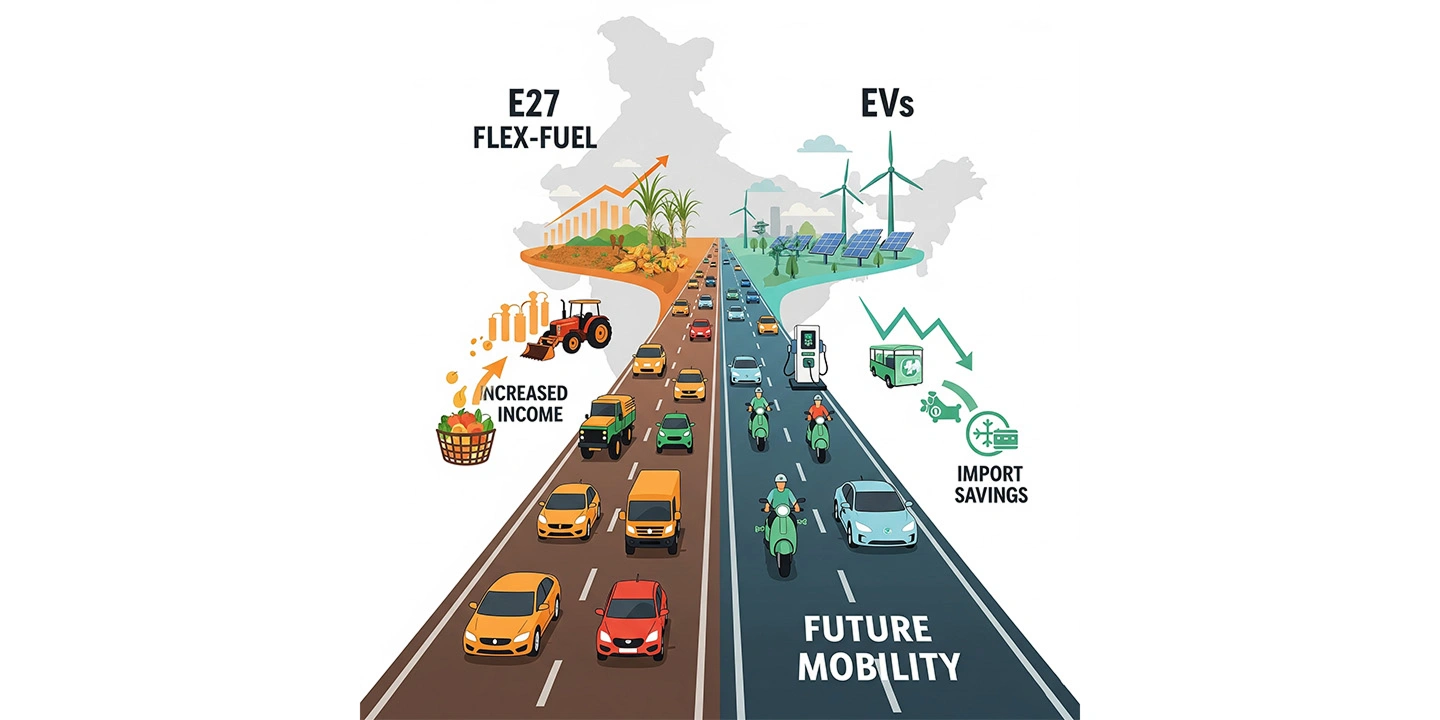

Think of E27 to Flex-Fuel as a credible second lane alongside EVs. With CAFE 3 set to credit flex-fuel contributions more fairly, manufacturers can mix strategies: ethanol-ready engines, strong hybrids, and EVs, rather than being pushed into a single technology corner.

For India, this also opens up bridges to farm income, import savings, and a practical way of life while charging infrastructure scales. The transport ministry has explicitly signaled this rebalancing, framing CAFE 3 as a system that values both battery tech and flex-fuel engines.

There’s a heated debate here. Some carmakers want relief for lighter, entry-level models, saying steep targets risk making small cars costlier. Others oppose carve-outs, and have openly warned that exemptions can affect competition and slow down ongoing emissions progress.

What’s clear is that missing CAFE 3 targets can usher in several penalties. So companies will either have to add efficiency tech, adopt more hybrids and flex-fuel capability, or trim less efficient variants. Each of this may have pricing implications for buyers.

Short term, most buyers will probably see gradual changes: more ethanol-capable models, more hybrids, and steady EV options.

As CAFE 3 kicks in, you’ll likely see better claimed fuel economy, improved emissions labels, and clearer flex-fuel compatibility.

Nitin Gadkari, India’s Union Minister for Road Transport and Highways, has shared a clear message. It’s that CAFE 3 will reward both EVs and flex-fuel, which could expand choices at multiple price points, especially if ethanol supply chains keep improving.

He has publicly stated that the upcoming CAFE 3 norms, due from April 2027, will be designed to give flex‑fuel vehicles (including those compatible with E27 blends) and electric vehicles a more balanced regulatory footing.

The aim is just as clear: cut crude oil imports, lower vehicular emissions, and boost reliance on domestically produced ethanol.

There’s going to be some portfolio math involved. Carmakers balancing CAFE 3 will pick a mix that hits the 91.7 g/km goal with the least cost and the most market appeal.

For many, this means hedging. What this entails is a few mass EVs in urban segments, strong hybrids among family cars and SUVs, and E27 to Flex-Fuel engines in volume models where ethanol blends are widely available.

This WLTP shift raises the bar on real-world efficiency, so software calibration, lightweighting, aero tweaks, and better transmissions will matter just as much.

Two things to watch out for here:

Government briefings present a pragmatic middle path that balances pollution, costs, imports, and agricultural benefits, with CAFE 3 slated to start in April 2027.

E27 to Flex-Fuel looks like a smart bridge that expands options, supports farmers, and buys time for charging networks to catch up. CAFE 3 gives that bridge regulatory weight, encouraging automakers to reduce CO2 across the board.

If the rules align as intended, we can all expect a more diverse car showroom by 2027, and a cleaner, more flexible road leading to India’s mobility goals.

CarOnPhone is your one-stop destination to see all upcoming cars, latest cars, released cars, and EV Cars, and compare Cars in all Car Brands. Stay tuned and follow us to update yourself on the automotive world.