Why Is Your Car Insurance Premium High? Key Factors Explained

- A car insurance premium is the amount paid to keep a vehicle insurance policy active

- Premium costs depend on factors like the car, coverage type, location and claim history

A car insurance premium is the amount paid to an insurance company to keep a vehicle insured. Many vehicle owners want to know what affects this cost at the time of buying or renewing a policy. In India, the premium is not fixed. It changes based on several clear factors linked to the vehicle, the driver, the place of registration and the type of cover selected

Knowing these points helps policyholders choose the right cover and manage insurance costs in a practical way

Catch the latest launches and updates on CarOnPhone!Key Factors That Influence Car Insurance Premiums In India

Type Of Car (Make, Model And Engine Capacity)

The make, model and engine capacity of a car play a major role in deciding the insurance premium

- Luxury cars and premium SUVs usually have higher premiums

- High repair costs and expensive spare parts increase insurer risk

- Cars with larger engine capacity are seen as higher risk

Because of these reasons vehicles with powerful engines or premium positioning generally attract higher insurance costs

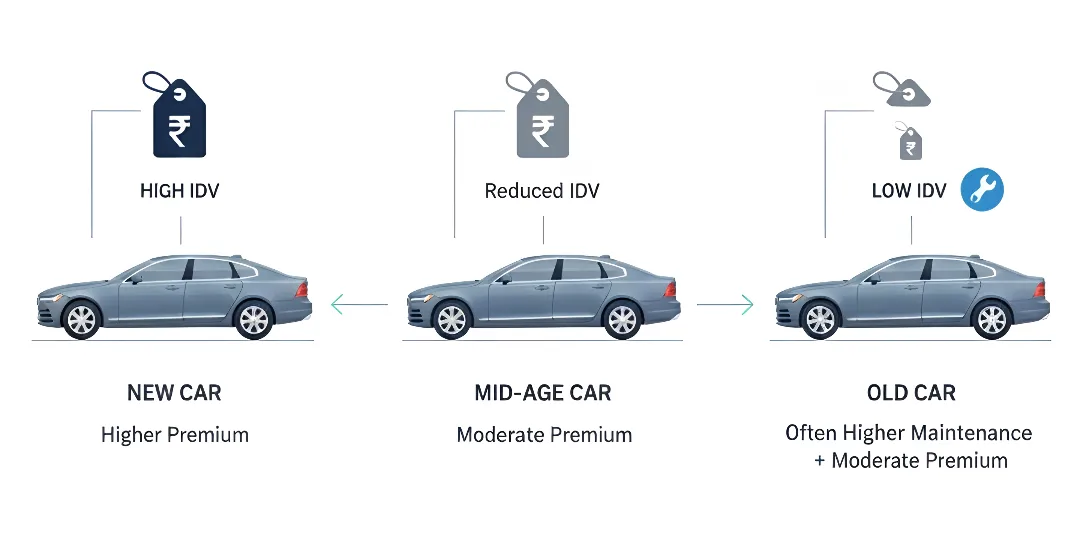

Age Of The Car

The age of the vehicle directly affects its market value and insurance premium

- New cars have higher Insured Declared Value (IDV)

- As the car gets older, its IDV reduces

- Lower IDV usually results in a lower premium

However, very old cars may sometimes attract slightly higher premiums due to frequent repair needs and difficulty in finding spare parts

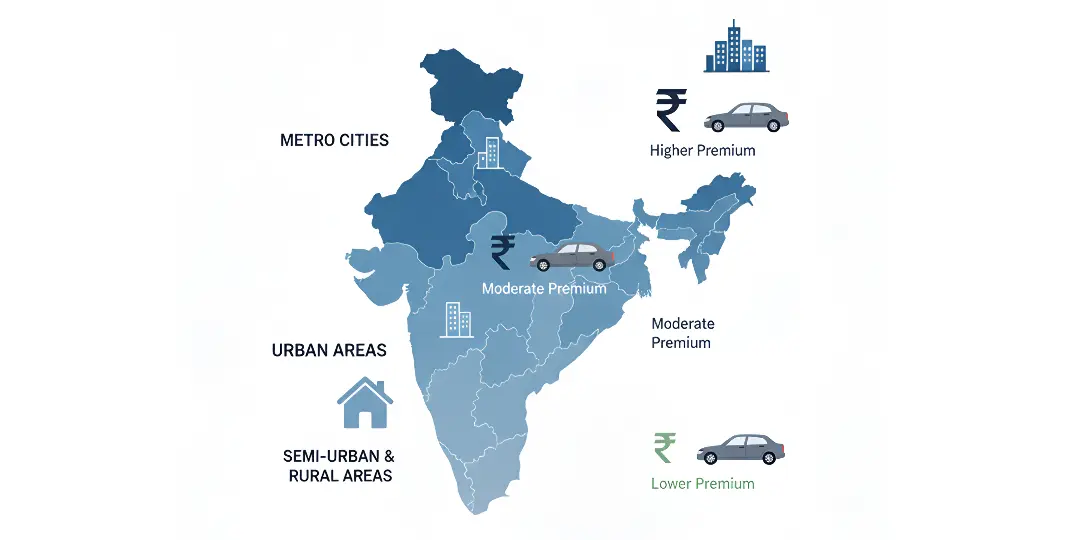

Location Or Zone Of Registration

The city or region where the car is registered also impacts the premium amount

- Metro cities have higher traffic density

- Accident and theft rates are usually higher in urban areas

- Premiums in cities like Mumbai, Delhi and Bengaluru are higher

Cars registered in smaller towns or less crowded areas often enjoy lower insurance premiums

Dash Light On? Identify the issue quickly with our Car Warning Light Guide.

Type Of Coverage Chosen

The kind of insurance coverage selected is one of the most important pricing factors

Third Party Insurance

- Mandatory by law in India

- Covers damage to other people or property

- Does not cover damage to the insured car

- Has a lower premium

Comprehensive Insurance

- Covers third party liability

- Covers damage to the insured car due to accidents, theft or natural events

- Offers wider protection

- Costs more due to broader coverage

Choosing comprehensive coverage increases the premium but also provides better financial security

Insured Declared Value (IDV)

IDV represents the current market value of the car

- It is the maximum amount payable in case of total loss or theft

- Higher IDV leads to a higher premium

- Lower IDV reduces premium but also lowers claim payout

Setting the right IDV is important to balance cost and coverage

No Claim Bonus (NCB)

No Claim Bonus is a reward given for claim free policy years

- It offers a discount on the premium

- Can go up to 50 percent over consecutive claim-free years

- A single claim can reduce or remove the bonus

Maintaining a clean claim record helps in reducing renewal costs significantly

Planning a Trip? Check Fuel Cost for your next trip with Fuel Calculator on CarOnPhone.

Add-On Covers Selected

Add-on covers provide extra protection but also increase the premium

Common add-ons include:

- Zero depreciation cover which pays the full cost of replaced parts

- Engine protection cover, useful in case of water damage

- Roadside assistance for breakdown support

- Return to invoice cover which pays the original invoice value

Choosing only necessary add-ons helps control premium expenses

Claim History

Past claim behavior is closely monitored by insurers

- Frequent claims increase perceived risk

- Claiming for small repairs can lead to loss of NCB

- Higher risk results in higher renewal premiums

Paying minor repair costs personally can sometimes be more beneficial in the long run

Safety And Anti Theft Devices

Cars equipped with approved safety features are considered safer

- Anti-theft devices approved by ARAI reduce theft risk

- Safety equipment lowers accident related losses

- Insurers may offer discounts on premiums

Installing certified devices improves vehicle security and can reduce insurance costs

Conclusion

Understanding what affects car insurance premium helps vehicle owners make informed decisions. Factors such as vehicle details, location, driving record and policy features all play a role in determining the final cost. By reviewing insurance needs carefully and selecting suitable coverage, it is possible to maintain good protection without unnecessary expense.

Also Read:

Court Challan Vs E-Challan: What’s The Difference? Payment Steps

Renault Duster & Nissan Tekton Spotted Testing Alongside Hyundai Creta

New Mahindra XUV 7XO Teaser Hints at Features Ahead of January 5 Launch

Tags:

CarOnPhone is your one-stop destination to see all upcoming cars, latest cars, released cars, and EV Cars, and compare Cars in all Car Brands. Stay tuned and follow us to update yourself on the automotive world.